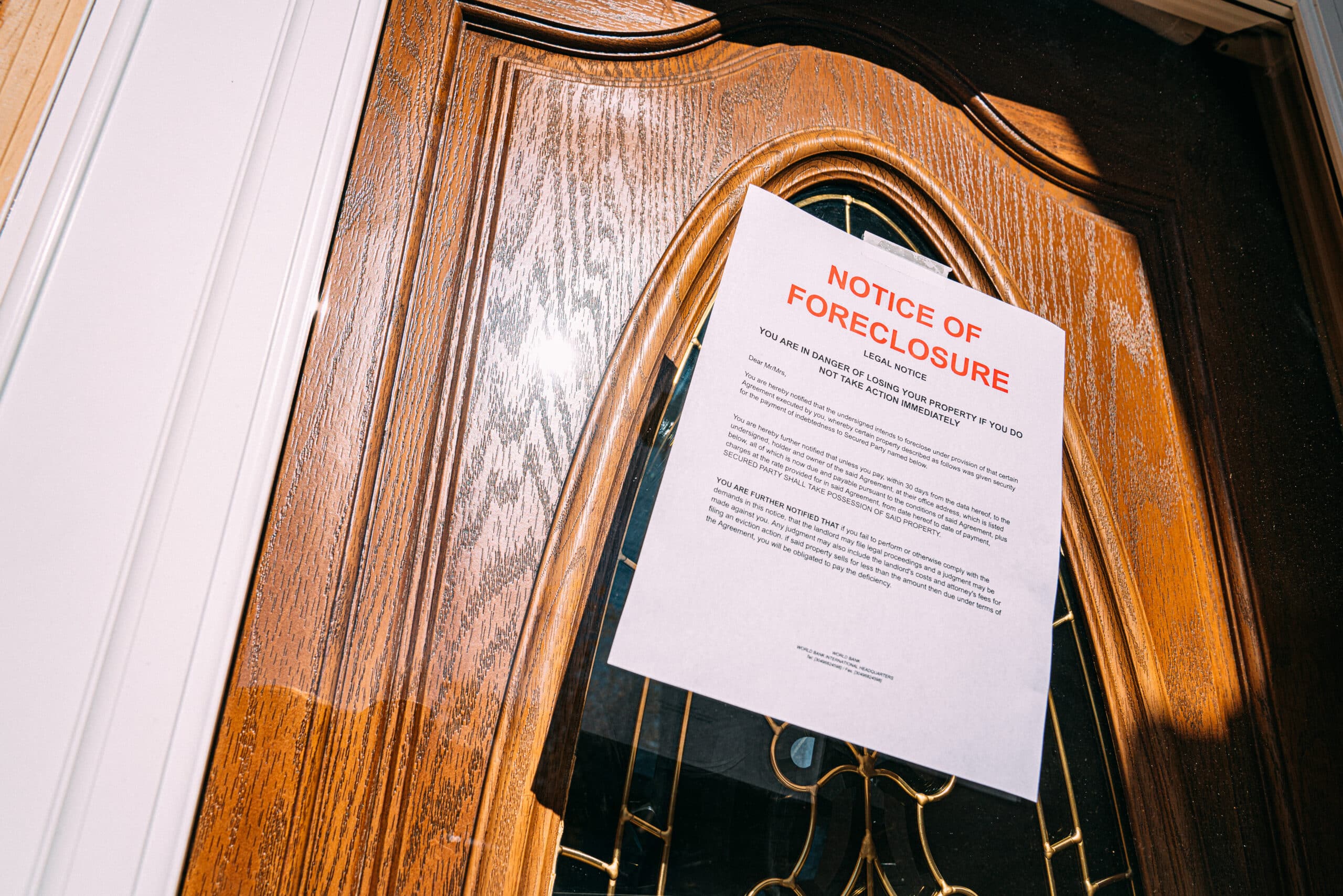

Foreclosure properties offer larger margins, but be mindful of the risks.

Whether you’re a homebuyer or real estate investor, foreclosure properties offer you the opportunity to purchase real estate at below-market prices. You can potentially save thousands of dollars, and this process often provides immediate equity and excellent investment potential. However, you’ll need to navigate complex legal issues (that vary significantly from state to state), understand unique risks, and move quickly when opportunities arise.

Sound potentially rewarding?

Big Picture

Foreclosure occurs when a homeowner defaults on their mortgage, and the lender takes legal action to recover the loan balance. The foreclosure process varies by state, with some requiring court supervision (judicial foreclosure) and others allowing lenders to proceed without court involvement (nonjudicial foreclosure). After completing the legal process, these properties are sold at public auction or through real estate listings, often at prices that are significantly below market value.

Benefits to Homebuyers

Foreclosure offers a homebuyer several options. As mentioned, you can save money on the purchase because you may be able to purchase a home at 70-80% of the market value, creating immediate equity. There is also less competition from traditional buyers who choose to avoid foreclosure due to its complexity. And, you may gain access to neighborhoods that could otherwise be outside your budget.

Benefits for Real Estate Investors

Likewise, real estate investors stand to reap potential benefits. For example, you may be able to achieve 20-30% annual returns by purchasing foreclosed properties. Consider also that buying foreclosed properties may help you build a portfolio more quickly. Finally, you have the option to flip properties for immediate ROI or hold them for rental income.

Consider the Risks

Title Issues. Foreclosure properties can come with clouded titles, unpaid liens, or ownership disputes. You could lose your entire investment if you don’t properly investigate title issues beforehand.

Buyer Beware. All purchases through foreclosure are as-is. Any sale is at the buyer’s own risk.

Property Conditions. You may encounter surprises related to the property conditions. Some buyers have discovered foundation problems, environmental hazards, or major system failures after closing.

Reclaim Possibility. Many states give former owners from 30 days to several years to reclaim their property after a foreclosure. This creates uncertainty about when you truly own the property.

Eviction Issues. You may own the property after a foreclosure, but how do you move people out? Properties that still have occupants could require expensive eviction proceedings.

Alternate Financing. Many foreclosure auctions require cash or hard money loans, eliminating traditional mortgage options.

Do Your Due Diligence

To safeguard against the risk, follow a due diligence process that protects you.

If possible, buy title insurance. The additional premium for the enhanced coverage protects your investment.

Check all potential liens against the property. Property tax liens typically survive foreclosure and become your responsibility. HOA liens, contractor liens, and judgment liens can also transfer to you, the new owner.

Review the property records and examine foreclosure documents carefully. Defects in the foreclosure process can make the sale invalid.

Although you can’t inspect the interior, visit the property multiple times to assess obvious issues.

And remember, you must have cash to pay at the sale.

In general, red flags include properties with extensive liens beyond the foreclosing mortgage, homes involved in ongoing litigation or bankruptcy proceedings, and properties with unclear title issues or ownership disputes

Seek Qualified Advice

Surround yourself with a team of qualified professionals to protect your interests, including attorneys, a title company, inspectors, and real estate agents.

An experienced real estate attorney can review documents, identify potential issues, and guide you through the process. The cost is minimal compared to potential losses. A title company with experience in foreclosure transactions is important because they will understand the unique challenges involved. Property inspectors and contractors can quickly assess properties and provide accurate repair estimates. Experienced real estate agents who are knowledgeable in foreclosures and have valuable market insights can guide you through the purchase process.

Foreclosure laws vary dramatically by state. Redemption periods range from zero days in some states to several years in others. Auction procedures, lien survival rules, and homestead protections all differ significantly. Research your target state’s specific requirements before pursuing any foreclosure opportunity.

Foreclosure properties can provide excellent opportunities for both homebuyers seeking affordable housing and real estate investors seeking to build wealth. The key is understanding that foreclosures are not traditional real estate transactions. You are dealing with motivated sellers (banks), shorter timelines, cash requirements, and unique legal challenges.

Success requires preparation, professional guidance, and realistic expectations about both the opportunities and risks involved.

If you’re looking for below-market real estate opportunities, foreclosure properties may be worth serious consideration.

0 Comments