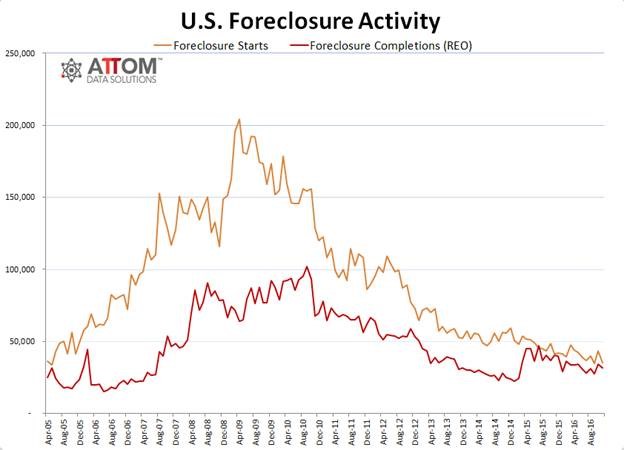

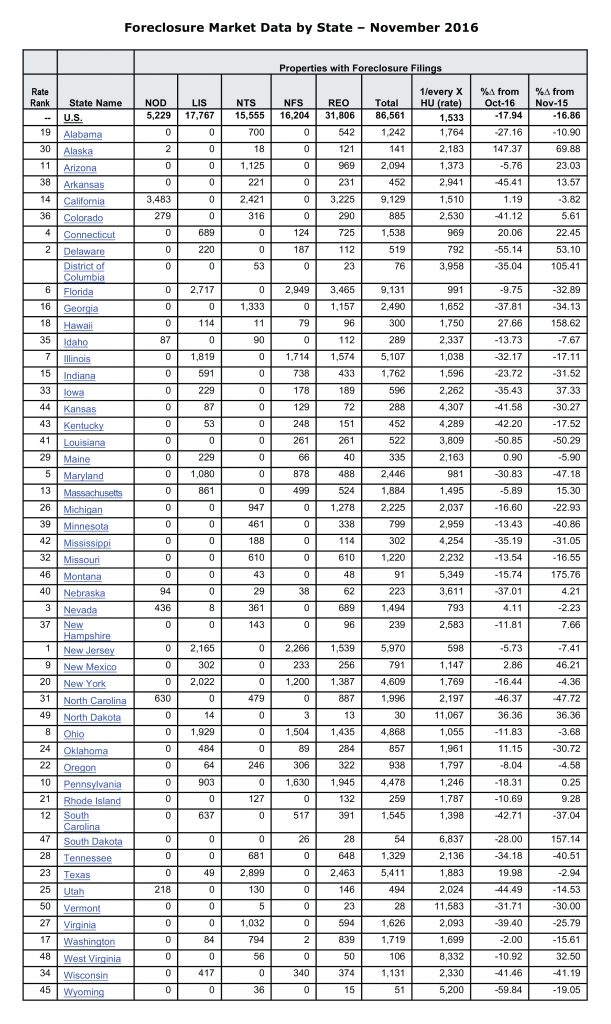

Total U.S. properties with foreclosure filings had a noticeable decrease of 18 percent in November, per a report from ATTOM Data Solutions, parent company of Realty Trac. The total 86,561 foreclosure filings in November was down 18 percent from the previous month and down 17 percent from one year ago.

This was the 14th consecutive month with a year-over-year decrease. The month-over-month decrease has been the largest decrease since November 2010. There were 32 states that posted year-over-year decreases in overall foreclosure activity, including Florida (down 33 percent), Michigan (down 24 percent), Missouri (down 17 percent), Washington (down 16 percent), New Jersey (down 7 percent), New York (down 4 percent), California (down 4 percent), Texas (down 3 percent) and Nevada (down 2 percent).

Properties Starting Foreclosure Process

There was a total of 35,222 U.S. properties which started the foreclosure process in November. This is down 19 percent from the previous month and 15 percent down from one year ago. November was the 17th consecutive month with a year-over-year decrease in foreclosure starts. Twenty-nine of the states posted year-over-year decreases in foreclosure starts to include: North Carolina (down 54 percent), Louisiana (down 45 percent), Colorado (down 43 percent), Nevada (down 29 percent), and New York (down 27 percent).

Repossessed Properties

The total amount of properties repossessed by the lender – REO – was 31,806. This number is down 7 percent from the previous month and was down 21 percent from a year ago. November was the ninth consecutive month with a year-over-year decrease in REOs.

Future Public Foreclosure Auctions

A total of 31,759 U.S. properties that were scheduled for future public foreclosure auction in November. This number is down 28 percent from the previous month and down 13 percent from one year ago. November was the 17th consecutive month with a year-over-year decrease in scheduled foreclosure auctions. The month-over-month decrease of 28 percent was the biggest month-over-month decrease since tracking began. There are 32 states posting year-over-year decreases in scheduled foreclosure auctions in November, including Maryland (down 38 percent), Indiana (down 23 percent), Illinois (down 19 percent), Alabama (down 16 percent) and Ohio (down 10 percent).

Highest Metro Foreclosure Rates

The metro areas with the highest foreclosure rates with a population of 200,000 or more in November 2016 were: Harrisburg, Pennsylvania (one in every 341 housing units with a foreclosure filing); Atlantic City, New Jersey (one in every 375); Trenton, New Jersey (one in every 524); Medford, Oregon (one in every 597); and Norwich-New London, Connecticut (one in every 615).

About ATTOM Data Solutions

ATTOM Data Solutions is the curator of the ATTOM Data Warehouse, a multi-sourced national property database that blends property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, health hazards, neighborhood characteristics and other property characteristic data for more than 150 million U.S. residential and commercial properties. The ATTOM Data Warehouse delivers actionable data to businesses, consumers, government agencies, universities, policymakers and the media in multiple ways, including bulk file licenses, APIs and customized reports.

ATTOM Data and its associated brands are cited by thousands of media outlets each month, including frequent mentions on CBS Evening News, The Today Show, CNBC, CNN, FOX News, PBS NewsHour and in The New York Times, Wall Street Journal, Washington Post, and USA TODAY.

0 Comments