This week we look at what kinds of tenants we get as we continue with excerpts from our survey “By Owner Corporate Housing Annual Report.”

This week we look at what kinds of tenants we get as we continue with excerpts from our survey “By Owner Corporate Housing Annual Report.”

In general, our experience has always been that corporate housing tenants are LPD (“less pain per dollar”) than tenants of vacation rentals. We asked respondents to tell us about their experiences with corporate housing tenants.

In 2013, more than 95% of respondents say they had positive experiences with their corporate housing tenants. This percentage is slightly higher than previous years.

- Experiences with Corporate Housing Tenants. Corporate housing tenants continue to be relatively “painless” tenants. In 2013, 95% of respondents say they had a positive experience with their corporate housing tenants – an all-time high for this report.

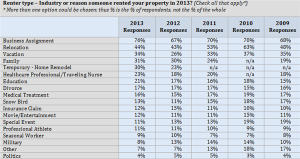

- Renter Types. In 2013, the top two reasons for rentals were: business assignments at 76% and relocations at 44%. The corporate housing renter pool went through some changes in 2013 – including a 9% increase in business travelers. We also saw an 8% increase in vacation renters, a 7% increase in people renting due to home remodeling, and a 5% decrease in military tenants.

- Lengths of Stay. Two out of three respondents say their tenants stayed an average length of three months or more. We found that 27% of properties could be rented for less than one month. However, on average, 84% of properties were rented for one month or more.

- Security Deposits, Travel Insurance and ARDI. 84% of “by owner” landlords say they required some form of a refundable security deposit in 2013 – similar to 2012. Also consistent with last year, 8% of respondents say they required Accidental Rental Damage Insurance (ARDI) as an alternative to a security deposit. 8% didn’t collect any type of deposit.

- Credit & Background Checks. In 2013, 32% of respondents told us, “Yes, they always run credit checks on potential tenants,” and 29% said, “Yes, they always run background checks.” Both these numbers are all-time highs for this report.

- Credit Cards. Approximately 60% of respondents say they accept some form of credit card payment from their renters. PayPal and Visa/MasterCard are virtually even in popularity at 36% and 35% respectively.

Renter Types

The corporate housing renter pool went through some changes in 2013 – including a 9% increase in business travelers. We also had an 8% jump in vacation renters and a 7% increase in people renting due to home remodeling. The latter reflects our current economy, in which many people are choosing to upgrade their current homes, rather than purchasing something new.

In 2011 and 2012, respondents noted a decrease in renters due to relocation stays. According to the ERC (Employee Relocation Council), there has been a rebound in new hire relocations, but there hasn’t been a return to the high volume of employees relocating within a company. Last year we predicted that relocations would increase in 2013, but we only saw a 1% growth. We continue to predict this number will increase for 2014.

With the reduction in military spending, we predicted a decrease in military tenants in 2013, and in fact, military tenants were down by 5%.

Trends that appeared in the “Other” category included: international shopping and interns (generally students working in corporations who need local housing).

For this survey question, we asked respondents to check every type of tenant they had during the year. As a result, the sum of the percentages is more than 100%. Click on the chart to enlarge.

0 Comments