In this article we pick up our Taste of Texas series, exploring the Texas real estate market at the beginning of 2019. Read the full intro here.

Going big in Dallas

Known as “The Big D,” the Dallas metro area had the largest population growth of any metro area in the United States in 2017, according to estimates from the Census Bureau. And U.S. News & World Report ranked it the 18th best place to live in the country in 2018.

The number of jobs there continues to grow as well, up 2.99 percent over the 12-month period ending October 2018, and rising 16.8 percent over the five-year period ending in October, according to Stewart Title Guaranty Company.

But there are signs of a market cooldown in the Dallas-Fort Worth metro, some of which were highlighted in a Wall Street Journal article with the headline “The U.S. Housing Boom Is Coming to an End, Starting in Dallas.”

Amuchastegui, the HomeRock co-founder, said he is seeing some signs of this cooldown.

“It feels like they have overbuilt in Dallas. Builders are giving discounts to sell,” he said, noting that the rise in mortgage rates in 2018 has contributed to the slowdown. “The market has started to slow. Changes in interest rates affect buyers’ purchasing power a lot.”

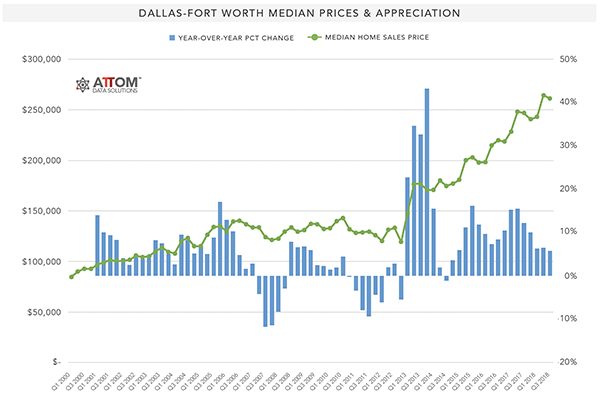

The median sales price for the entire Dallas-Fort Worth metro area in the third quarter was $261,250, a 1.2 percent quarterly decrease but 5.8 percent above the price reported for the third quarter of 2017 — the slowest rate of annual appreciation since Q4 2014. Still, median home prices in Dallas-Fort Worth have increased 119 percent from the post-recession bottom price of $119,253 in the fourth quarter of 2012.

The slowdown’s silver lining is improving affordability. ATTOM Data Solutions reported a 1 percent improvement in housing affordability in Dallas County during the third quarter of 2018, although affordability was still down 10 percent from the same quarter the year before.

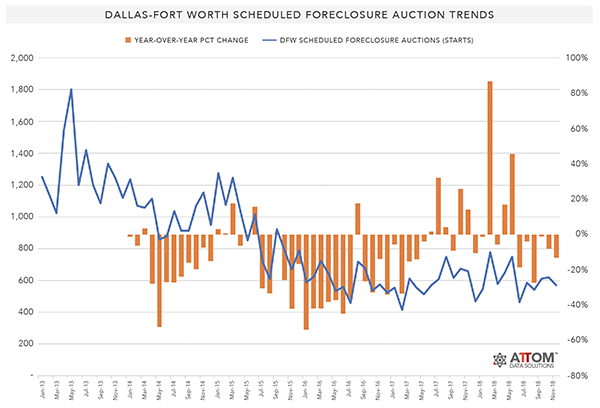

“Dallas is a very business-friendly city. The houses are very affordable. That’s the draw for Dallas,” Amuchastegui said, noting that most of what his company buys are properties sold via foreclosure auction. “Ninety percent of what we do is buy on the courthouse steps. We buy and sell about 20 percent then use the profit as equity to refinance the other 80 percent that we keep as rentals.”

Scheduled foreclosure auctions in the Dallas-Fort Worth metro area declined 13 percent in November compared to a year ago, but are still up for the year, according to ATTOM Data Solutions. A total of 6,694 properties in the metro area were scheduled for foreclosure auction through November, up 3 percent from the same time a year ago.

Memphis Invest partner Chris Clothier still considers Dallas a vibrant market for single-family home investors because of all the wholesale activity going on there.

“We’re in that sweet spot of rental property. We’re not competing with everyone else who wants to be cheap and compete on price,” Clothier said. “Our price point is $150,000 to $225,000.

Once you get above $200,000 you have fewer investors who want to commit that much money to a passive investment. In reality, those houses tend to be the best performers.”

When it comes to buying in Dallas, Clothier is talking about a 2,000 square foot home with three or four bedrooms and two baths, an attached garage and a backyard.

“We’re appealing to a higher-income-earning family. You get a more stable resident; therefore, your income flattens out. It’s the more expensive property that may not feel like it cash flows as well, but over a period of time it costs less to hold it,” he said.

The monthly rent on a three-bedroom single-family home in Dallas County rose 4 percent in 2018 to $1,563 a month, for an annual gross rental yield of 8.9 percent, according to ATTOM Data Solutions.

Plus, Clothier said investors are having a positive impact on the market by giving complete overhauls to the many homes that were built before 1985.

“Investors are putting their money to good use in Dallas, making them like new. It’s a good thing for Dallas — bringing them up to code,” he said. “Investors want to be in this market because they think it’s a safe place for their money.”

0 Comments