Rumor has it that real estate investors are throwing in the towel on California. Even before Covid, investors were increasingly uncomfortable with California politicians and regulators, seemingly set on making an entrepreneur’s life difficult. Local-level rent control, outlawing vacation rentals, and changes to the foreclosure process meant investors of all sorts had no place to hide.

Other investors are contemplating an exit strictly as a retirement and diversification play. During the Great Recession, real estate investors created rental portfolios purchased well below replacement costs. It’s natural to step back at a portfolio that’s tripled in value and wonder if there’s something better your capital could be doing.

For some, real estate is a means to an end. For others, real estate is a game they will never stop playing. Regardless of where you land on the spectrum, there are opportunities and threats investors should consider while pondering a California exit.

Explosion in Foreclosures?

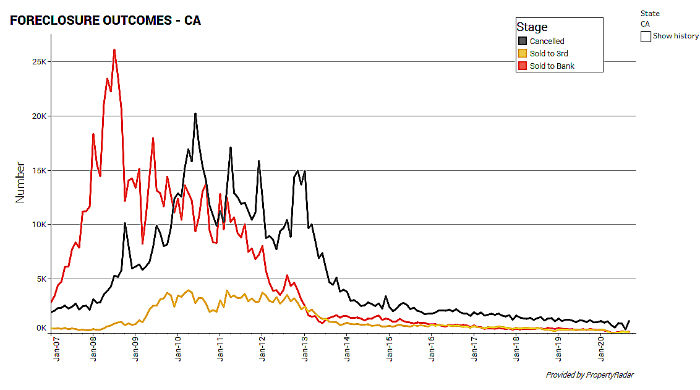

First, expect the media to run headlines in the first quarter of 2021 about a foreclosure explosion. Remember the moratoriums on evictions and foreclosures through the end of 2020 mean these will be pre-Covid numbers that stalled.

Foreclosure activity in California remains at a historic low. A post-Covid foreclosure wave may appear by summer 2021, but not in the quantity that investors would hope for or expect. Unlike the last cycle, buyers had to qualify for loans under ability-to-repay rules. Homeowners are also sitting on equity they’ve been far more conservative with over the last decade. Simply put, some of the fuel for the fire that triggered the financial meltdown does not exist this time around.

Additionally, Congress and the Feds have made it clear more Covid-related support is on the way in some form. With that, consider two categories that investors should consider when approaching California real estate.

#1: The Price Tag

Stay. Real estate investors are locking in long-term financing for rentals in the mid-three percent range. The deal is not in acquisition; it’s financing. California’s median price has gone from $274,960 in 2009 to over $700,000 headed into 2021. With 25 percent down and a 3.5 percent rate, the payment is $2,350. Rents in some markets will support this play but at cap rates that aren’t exciting. Investors must also consider that the Covid trends of 2020 in localized markets will likely cool. Playing the long game in California, which typically trends up, seems like a safer bet.

Run. If you’re an investor who purchased between 2009-2014, you have options and are probably laughing at investors trying to jump in now. You can refinance at all-time low-interest rates to buy more property or take the money out of state to areas that make more cashflow. You could exit entirely via 1031 exchange and upgrade and diversify into multiple markets in addition to taking advantage of these amazing interest rates. Or, you could stay put, sit back, and relax because you have the exact portfolio you want.

Consider this, real estate is not just a numbers game. Some investors do not like being more than an hour’s drive away from their assets. Others demand absolute control of management.

If California’s prices haven’t scared you away, category #2 is a key reason many are packing their bag for other states.

#2 Regulatory Environment

Stay. In the supermajority, Democrat-party-controlled State of California, outsiders might be curious why it can’t get its affordable housing act together. Governor Gavin Newsom stated in 2017 that housing was a fundamental right and that his goal was to lead the effort to develop 3.5 million new housing units by 2025.

So, what’s the issue? Politics. Builders hilariously call states like California BANANAS (build absolutely nothing anywhere near anything-ers). The high cost of dirt, exorbitant development fees, expensive building code, and onerous timelines stuck in CEQA litigation have builders steering clear of affordable housing projects. The City of Los Angeles raised $1.2 billion in 2016 to tackle 10,000 affordable housing units. Unfortunately, four years on, not even the city has been able to manage keeping prices down. In September, the city controller announced that the measure is not only behind, but the per-unit cost has ballooned to $530,000.

The real culprits are NIMBYS (not in my back yard-ers). These locals show up to council meetings to protest projects. California has attempted for years to pass legislation that allows density projects along transportation corridors. The efforts have failed because NIMBYs show up and protest to their local elected who put them in office. They don’t want the neighborhood’s character to change, and constraining supply means prices continue to increase. Measure blocked!

California’s brilliant answer to the NIMBY problem has been accessory dwelling units (ADUs) legislation. By right, local property owners can build secondary structures on their property. Local governments and HOAs resisted by instituting huge development fees, parking restrictions, and absentee owner restrictions. But, the state has continually responded and legislated those objections. If you’re building a 750 square feet ADU on an existing California rental, your application should be approved within 60 days, have minimal fees attached, and no local politicians, building department, or neighbor can do much about it.

In all fairness, California is trying. Some cities are paying for ready-made ADU plans. Others have incorporated tiny homes into their ordinances. One city is even in discussion to allow up to six ADUs on a qualified lot zoned R1. Local investors plugged into upzoning can take this effort even further and make some unique, long-term portfolio plays.

Run. Even before Covid, California municipalities had budget issues largely tied to poorly funded state pensions. Covid has exacerbated budget issues leaving states with few options other than to increase local sales taxes, building fees, and other fees to plug the gaps.

Currently, the state of California is looking at a $54 billion shortfall. Measures adopted to stop the fiscal bleeding include the use of reserves, reduced spending, borrowing, federal grants, and cutting education spending. With an unemployment rate stubbornly high, the state will continue to seek additional sources of revenue.

On the 2020 ballot, three real estate initiatives offered a way forward.

Proposition 15: The most controversial of all sought to change California’s well-known Proposition 13 tax policy of charging one percent property taxes based on the purchase price, then tied to inflation afterward with a cap of two percent. The bill specifically targeted commercial properties over $3 million in value. Voters keep saying “No” to changes to Prop 13 but it continues to be brought up as a key change necessary to raise state revenue for government services and education. The proposition appears to be a no-go but the vote was too close for comfort.

Proposition 21: California’s effort to give more local jurisdiction over rent control. With almost 60 percent of voters saying “No,” it appears Californians don’t trust municipalities with rent control policing power. Even before Covid-related eviction moratoriums, California had already instituted statewide rent control measures like the Tenant Protection Act of 2019 (AB 1482). The issue of affordable housing is complicated, and California needs a holistic approach to fix it. Apparently, we don’t have that willpower and it is far easier to make landlords the villain.

Proposition 19: This measure is likely to pass and allows seniors (55+), the disabled, and victims of wildfire/disasters to transfer their primary residence’s tax base to a replacement property. The trade-off is that children who inherit properties must move into the property and use it as their primary residence if they hope to retain the tax basis of their parents. Obviously, that’s a major factor in coastal markets for families with multiple rental holdings.

Estate planning attorneys will be busy in 2021 because none of this considers the new administration’s initiatives. Tax increases, a $15,000 first-time tax credit, and potential changes to the 1031 exchange rules are all topics in discussion. Outside of how California will impact your pocketbook, the entire industry heads into 2021 with much uncertainty.

Opportunity for California Locals

Be cautious of high-end projects with massive repair budgets and extended timelines in California. Covid has backed up many building departments. Also, skilled labor, material price increases, and supply delays will continue to be a challenge in 2021.

Wall Street institutional money and ibuyers continue to expand in California, but they’ve been here for years. Wall Street activity does tend to decrease profit margins and increase marketing costs depending on where they land, so investors need to pay attention. Institutional money seems better poised to chase note pools or the build-for-rent model instead of courthouse-step buying this time around. California SB 1079 introduced a redemption period in 2020 that institutional money won’t like. And ibuyers seem singularly focused on speed and will avoid big rehabs.

Many opportunities exist in California. While cashflow may be challenging at current prices, interest rates are half of what they were in the last cycle. ADUs and density projects open new categories of opportunities for investors with skills in creating equity and structuring deals where equity is difficult to buy off the shelf.

Data-driven local niches around referrals, value-add projects, and off-market deals will continue to shine in 2021. In your niche, talking to the right prospects in the right channels will go a long way to saving you time and money as competition increases.

Aaron Norris is VP of Market Insights with PropertyRadar. He writes and speaks nationally on data, trends, and technology. He’s a licensed real estate and mortgage broker and has been in the industry since 2005.

0 Comments