The financial world is paralyzed, waiting for the Fed Thursday.

The financial world is paralyzed, waiting for the Fed Thursday.

At the outset, hang on tight to one thing: the U.S. economy is doing so well that if it were not for the rest of the world the Fed would have begun liftoff months or even years ago. We are not growing fast, our new GDP speed limit only about 2%, but jobs are plentiful, housing is entering a growth phase beyond recovery, and only wages are sticky.

Wages and therefore inflation may stay stuck, but with unemployment crossing below 5% a 0% Fed is inappropriate.

My vote for next Thursday: lift .25% and see what happens. This fitful go/no-go and Groundhog Day debate is distracting from important things, like football.

The Fed may hold off because inflation forces are all pulling downward, and because there is no reliable way to measure the future impact on the U.S. of an outside world in trouble. In the 1997-1998 “Asian Contagion,” the Fed panicked about global recession, but it turned out that overseas trouble was a benefit here, and the Fed’s easing poured gasoline on a stock-market bonfire. This time is different.

Europe and the BRICs

Europe is so sick that the European Central Bank (ECB) this week guaranteed additional and extended quantitative easing ( QE.)

Then the BRICS, the emerging darlings of finance, investment, and bond and stock huckstering.

- “B” for Brazil, which this week submerged to junk bond status. Its currency is worth about half its value two years ago. Its government and upper-crust leadership have been exposed as completely corrupt. Its over-reliance on commodity exports has produced a structural fracture with no prospect of cyclical recovery. At some point a dead-varmint bounce, and social unrest likely.

- “R” for Russia. Czar Vladimir made a pact with Russia’s worst impulses, and the bill is due. A gangster state, in which any successful entrepreneur will pay protection until a goon steals the whole business. All the weakness of any petro-state, with an otherwise shriveled economy, petro production itself starved of investment, and petro prices less than half the level necessary to keep the gangs going. Belly-crawling to China has been fruitless. Oil under $50, Vladimir has a couple of years before… the knock at his door?

- “I” for India. The bright spot. Still growing, but the rupee in bad trouble because markets for its exports are in trouble. Its deepest weakness: the caste system and corruption blockade any prospect of widespread modernization and population control. May get some cyclical rebound, but structural issues are intractable.

- Skipping to “S” for South Africa. Another busted commodity state, little of export merit otherwise, the rand in free-fall. Unresolved social issues.

- Then “C” for China. Everybody gets the black box: the world’s second-largest economy, 1.3 billion people, the focus and funnel of world trade, but so thoroughly deceitful about its data that the world can’t tell what’s going on inside. And that of course is what’s wrong inside. China is not a gangster state like Russia — it has its murky clans and the rotten Party, but its self-theft is for public good. China’s black-suit and shoe-polish-hair leadership is a collective control freak, perfectly understandable given China’s several-thousand-year tendency to fly apart. Its command economy is not Soviet-style incompetence — China truly intends a meritocracy.

Fatal for its plans: last week the lead reporter for a top China business journal was arrested and charged for the crime of “independent inquiry.” China is hitting the great wall of social capital. Markets cannot function without a free flow of information. In a healthy society, business conversations always overlap with government policy consideration and open political debate. No modern economy can function without a reliable, fair, and independent legal system. Command economies always fail: you cannot order people and businesses to be flexible while simultaneously forbidding flexibility. You can get only so far with the hammer, and then it’s the problem.

China is not likely to hard-land, but its supercharged leadership days are done.

So, if you’re Chair Yellen, you want to tighten into that?

Probably.

——————————————————————-

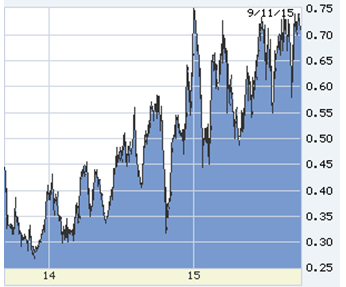

10-year T-note two years back. I find no pattern guidance. We overdid the post-taper decline last winter, then over-did the rebound… now clueless. But long-term rates may not move at all when the fed lifts off — a lot of frightened global money headed here.

I think the Fed-sensitive 2-year T-note is already bracing for the hike after liftoff. Many on the Street think the Fed will one-and-done; the very best traders think the Fed will keep going at low slope:

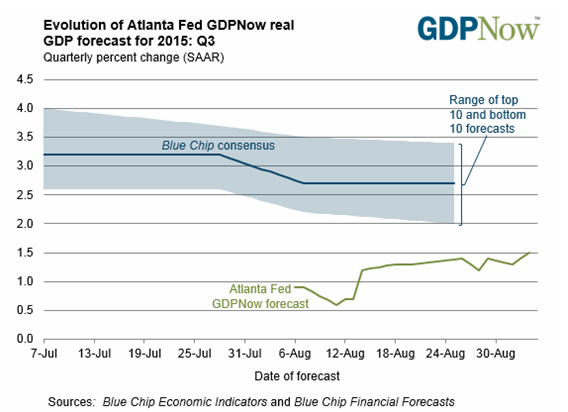

The Atlanta Fed GDP tracker has done well (not its income tracker). The third quarter is almost over, and after a weak first and rebounding second, back to two-ish at best.

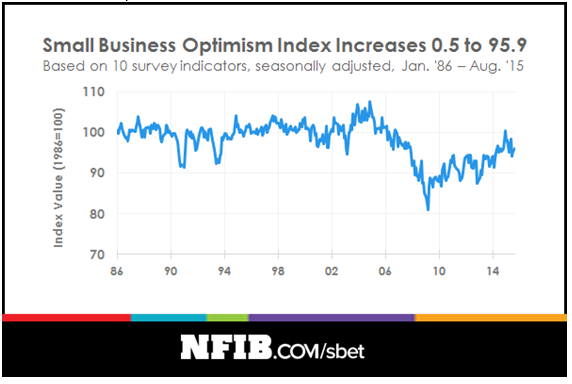

Small business okay, sort of, but acceleration has faded.

I may be the only one not to have noticed, but the Fed has already begun to shed a lot of long-term bonds bought during the height of QE and flipped to short Treasurys. Very good news! Means that when the Fed begins to stop reinvesting as Treasurys on its balance sheet mature, much less chance of a market shock to long-term rates.

Brazil’s real looks like the ruble (chart inverted: more real/dollar = weaker). One way or another, corruption and over-reliance on commodities got ‘em both. Brazil will not be buying much of anybody’s exports for quite a while.

0 Comments