The financial world is back on a familiar precipice: a giant global-regional economy is on a cusp, all waiting to see if its government will intervene.

The financial world is back on a familiar precipice: a giant global-regional economy is on a cusp, all waiting to see if its government will intervene.

This time it ain’t us — it’s Europe, again — the shockwaves for the moment beneficial to the U.S. Mortgages are on their 2014 lows, near 4.00% taken down by the U.S. 10-year T-note now 2.31%, itself taken down by a new low on the German 10-year, 0.845%. One more inch down, and long-term U.S. rates can fall another quarter-point quickly. Not a prediction, but a middling probability.

The immediate push toward this edge has been a new European recession, this time including Germany. Euro foolishness has been clear for several years, poor-productivity nations bolted to the uber-productive German hive and its Deutsche-gelt standard. The others so love having German money in their wallets that they’ll tolerate 50% youth unemployment and German demands to adopt German behavior. In return Germany has done everything possible to ruin the experiment: it runs a trade surplus more than 6% of GDP (double the treaty maximum), and has this year balanced its budget.

Germany’s GDP is going negative

Each time Europe has reached a breaking point the European Central Bank (ECB) has intervened by jawbone. First a run on non-German banks, then the moon-shot of non-German sovereign yields — each time the ECB has threatened to bury anyone trading against it. But the Germans have not allowed the ECB to do anything, especially a Fed-like QE operation.

Each of the prior ECB jawbones has produced global financial relaxation, just like each QE here, rates up, stocks up. This time the ECB’s problem is not a run, it is the fundamental cracking of the European economy. The Germans in epic rigidity have failed to see that a net-export surplus to others in the same currency will wreck their ability to buy. Germany has allowed the ECB’s rapid devaluation of the euro, a benefit to German exports to non-euro buyers, but within the euro zone a euro is a euro is a euro. And so it has come to pass: Germany’s GDP is going negative, its exports failing.

Back to the interest-rate brink: if Germany allows dramatic Council of Europe Bank (CEB) action, or adopts equally dramatic deficit spending, then global markets will quiet, rates back up. Most likely Europe will announce timid measures which will buy time but not stop deflation, and we’ll be back in this soup in months or a year.

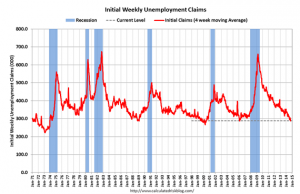

Here in the U.S., the world’s best economy, we can enjoy black humor. The events above have put the U.S. Fed in a state of cognitive dissonance. We have to raise the cost of money from zero, and we’re probably late to do it. Every time we talk about doing something mean, like going all the way to 1% in a year or two, the stock market faints. Every time we say we may hold off, stocks take off again. Can’t have the stock market trading on us. The unemployment rate has fallen faster and farther than ever occurred to us. Only a little more than a year ago we said 6.5% would trigger action. New claims for unemployment insurance have reached a 40-year low. Must mean overheating and wages and inflation are nearby. Right?

Real estate and housing soggy at best

Housing is soggy at best. Credit card debt is falling. Car sales are propped by subprime loans that are really instant-cancel leases. Wages are not growing at all. The gap between U.S. performance and the outside world has never been greater — not since World war II. Not after the war, in it. Prices of imported goods fell a half-percent just last month. Commodity prices have tanked. U.S. inflation is going down, not up.

Sensible Fed-speakers now sound nuts. Five years ago, the cost of money at zero, the Fed began to reassure markets by saying it would stay there “a considerable period.” The Fed’s Yellen-picked vice-chair, renowned Stanley Fischer this week defined the period as “two months to one year,” shorter than anyone in the markets ever believed and contradicting the whole “considerable” concept. NY Fed prez Dudley has been the most lucid in the last month, hinting repeatedly that the Fed would be slower to hike than it’s mid-2015 estimates, but this week said that frame was reasonable.

Watch Europe for now, not this sit-and-shake Fed. If Europe does not save itself, our Fed can be right back in deflation-fighting.

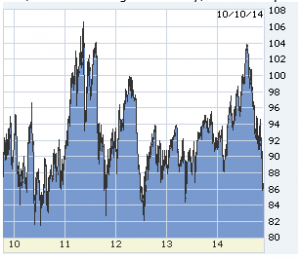

U.S. 10-year T-note, last year. The run up in September was Fed-anticipating and a bit of correction. Canceled by the outer world. Click on the charts to enlarge.

10s in the last two years — there is very little resistance below 2.30% to a much deeper move.

The current level of claims has induced inflation in the last five recoveries — note how quickly new recessions followed these lows, the labor market having overheated each time. Nobody really knows what this measure means now — or “unemployment” for that matter.

Oil, five years back. At $86 the drop is over — any lower and drilling stops. This is the one, self-controlling commodity, which will push back at deflation forces.

Copper is the best economic predictor, and not pretty.

The euro has stopped falling — stopped by dovish words from the Fed. If the Fed really has to move, non-US currencies will dive again, which the Fed knows and is obviously worried about.

[hs_form id=”4″]

0 Comments