Last week’s top economic stories are two processes underway which no one understands.

Last week’s top economic stories are two processes underway which no one understands.

In lesser matters, mortgage and long-term rates remained steady. The election will alter discussions in Congress, but danged if I can find an economic event.

The first unknown: how long can hiring continue and layoffs fall before wages rise, possibly in an inflationary spurt?

Theoretically, historically, we are already on impossible ground. In October another 214,000 jobs, upward revisions in prior months, unemployment down to 5.8%, even U-6 (including “involuntary part-time”) down to 11.5% from 15%, but hourly wages “grew” only $0.03, by 2% year-over-year.

Wages, unemployment and inflation

How low could unemployment go before igniting wage-paying competition among employers? 5%? 4%? 3%? What if the Fed acts pre-emptively but unnecessarily?

The Fed is so concerned that it asked its 22 primary dealers, and five said that if the Fed hiked its overnight rate next year it would be back to zero within two years.

The steady, 200,000-per-month job gains have suspicious elements. The October manufacturing ISM survey was a red-hot 59, yet manufacturing payrolls gained only 15,000 jobs. Half of the October overall gain was in bottom-wage, poor-stability retail and hospitality work. No other aspect of the economy matches the theoretical strength in hiring: factory orders tailed .6%, CoreLogic found home prices off 0.1% in September and the year-over-year gain slipped to 5.6%.

What about Europe and Japan?

The second unknown itself comes in two pieces: what impact will desperate attempts at recovery by the rest of the world have on the US, and are the ex-US central banks already past the point of no return?

The tale of woe following is not meant to depress; if anything it should make you glad you live where you do — even after two months of incessant and stupid election ads. First the overseas conditions, then the mechanisms affecting us.

Europe has cut its growth forecast for next year to 0.8%, and its PMI right now is a breakeven 50.6, annual “inflation” 0.4%. Italy is contracting, yet its national debt is growing another 5%. The ECB’s Mario Draghi is bluffing QE, and no one responds except Pavlovian stock markets. That non-economic response warns that once interest rates have fallen near zero, QE washes uselessly over economies into bubbled markets — and that opinion comes from a believer in central banks and early-stage QE.

Japan. We have better numbers after last week’s BOJ adoption of Draghi’s words (“anything necessary”) and the most extreme central-bank action anywhere in history. The BOJ already has bought securities equal to 60% of Japan’s falling GDP, which in dollar terms is $4.8 trillion now versus $5.9 in 2012 (the US is over $17 trillion). Japan’s tax revenue covers half its spending, its annual deficit $365 billion, the BOJ buying Japanese bonds at double the rate of deficit. The BOJ now owns 20% of JGBs outstanding, but JGBs total more than double Japan’s GDP. To date, BOJ QE has caused prices to rise, but price-adjusted incomes fell 6% in the last year.

Japan is a painfully disciplined society, while Europe is politically fractured. But the test is underway in Japan: at what point in QE on this scale is the yen wallpaper?

To one degree or another, the whole external world is trying to devalue versus the dollar, in a panic (that’s the right word) to escape the gravity-well of a deflation black hole. The threat of Fed tightening while all others run their presses makes the currency adjustments violent.

Oil prices dropping, no inflation

Here, the benefits: cheap oil, cheap imports, no inflation. The risks: exports drop, and falling wages overseas via imports pull down wages here — the others export their deflation and unemployment.

An overstrong dollar is a net drag here, but can take many months to develop. The overseas risks: a rocketing dollar crushes dollar-borrowers, and there are a lot of them. Trillions. Their falling currencies cancel lower oil prices, lower only in dollars.

Here, all looks well out the window, even placid. To figure out what comes next, we all have to look around the curve of Earth, where the action is.

—————————————————–

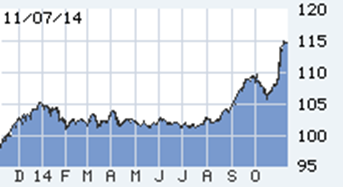

US 10-year T-note in the last year. Was poised last night to scream on a strong jobs report, but we got another pseudo-strong one. Traders know the Fed is in a box:

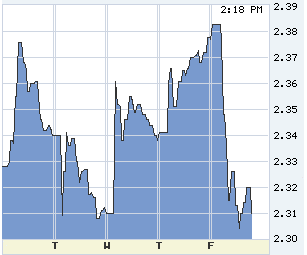

US 10-year T-note first week of November. Today’s ( Nov. 7) move is stark, econo-bulls covering their shorts:

The Fed-predictive 2-year T-note in the first week of November looks just like 10s — fewer and fewer insiders think the fed is coming at all next year:

The euro in the last year:

The yen in the last year. Remember, number of yen per dollar, up is weak. Two years ago was 80/$, down in value now by 30%:

The ruble in the last year, rubles/$. The bars are monthly moves. The ruble has lost the same percentage value in four months as the yen has in two years. Sanctions the driver, not deflation; inside Russia, inflation 8% and rising, its central bank rate to 9.5% last week. Much as I hope for terminal pain for Putin, if the Russian people stay with him the consequences of sanctions can be dangerous for us all:

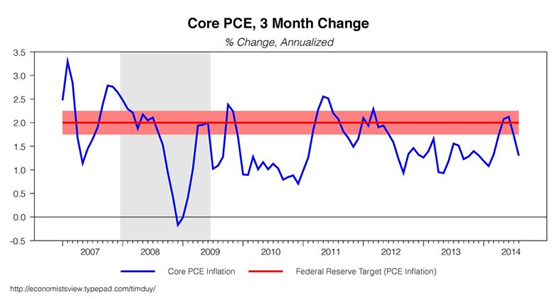

If you have time to watch one thing, watch US inflation. If core PCE falls below 1%, the Fed will have to find some way to prick the stock market bubble other than by raising its rate:

[hs_form id=”4″]

0 Comments