When crunching the data for our Q3 2016 Single-Family Rental Market Report, ATTOM Data Solutions identified five sets of local markets representing different types of opportunity in the single-family rental space based on investor preferences and appetite for risk. Let’s look at each of those in some detail.

Low Vacancy Rates and High Potential Yields

Low Vacancy Rates and High Potential Yields

We identified 22 local markets with the sweet combination of low vacancy rates and high potential rental yields on properties purchased in 2016.

We identified these markets out of the 473 U.S. counties analyzed in the report by limiting the list to only counties with an investment property vacancy rate below 3 percent (the average across all 473 counties was 4 percent) and a gross annual rental yield (annualized rental income divided by median sales price) of 10 percent or higher.

The five most-populous counties making the list were El Paso County, Texas; Orange County, New York, outside of New York City; Westmoreland County, Pennsylvania, in the Pittsburgh metro; Lehigh County, Pennsylvania, in the Allentown metro area; and Marion County, Florida, in the Ocala metro area.

Counties with the highest rental yields on this list were Monroe County, Pennsylvania, in the East Stroudsburg metro area (16.0 percent); Hernando County, Florida, in the Tampa metro area (14.3 percent); Lackawanna County, Pennsylvania, in the Scranton metro area (12.1 percent); Westmoreland County, Pennsylvania, in the Pittsburgh metro area (11.8 percent); and Davidson County, North Carolina, in the Winston-Salem metro area (11.8 percent).

So it is possible to have your cake and eat it too when it comes to single-family rentals. But of course, you’ll notice that many of these counties are a bit off the beaten path and not in the major markets where institutional investors and other single-family investors have swarmed over the past few years. That lack of competition helps these markets maintain the sweet combination of solid returns and low vacancy rates.

High Rental Returns and Wage Growth

High Rental Returns and Wage Growth

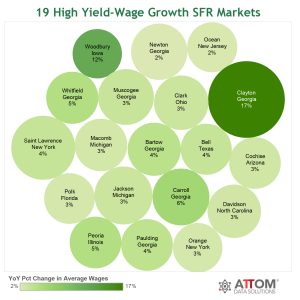

For our list of 19 best markets with a combination of high rental returns and wage growth, we narrowed down the list of all 473 counties analyzed in the report to just those with a potential gross annual rental yield (annualized rental income divided by median sales price) of at least 10 percent for homes purchased in 2016 and also with annual growth in average weekly wages in Q1 2016—the most recent average weekly wage data available at that time from the Bureau of Labor Statistics.

The five most populous counties making the list were Macomb County, Michigan, in the Detroit metro area; Polk County, Florida, in the Lakeland-Winter Haven metro area; Ocean County, New Jersey, and Orange County, New York, both in the greater New York metro area; and Bell County, Texas, in the Killeen-Temple metro area.

Counties with the highest annual gross rental yields on the list were Clayton County, Georgia, in the Atlanta metro area (24.3 percent); Saint Lawrence County, New York, in the Ogdensburg-Massena metro area (16.9 percent); Jackson County, Michigan, in the Jackson metro area (13.9 percent); along with Carroll County, Georgia (13.3 percent), and Newton County, Georgia (13.1 percent), both in the Atlanta metro.

Counties with the strongest annual weekly wage growth on this list were once again led by Clayton County, Georgia (17.4 percent); followed by Woodbury County, Iowa, in the Sioux City metro area (12.2 percent); Carroll County, Georgia, in the Atlanta metro area (6.0 percent); Whitfield County, Georgia, in the Dalton metro area (4.8 percent); and Peoria County, Illinois, in the Peoria metro area (4.8 percent).

High Potential Yields and Low Owner-Occupancy Rate

High Potential Yields and Low Owner-Occupancy Rate

We identified the 18 best markets for buying single-family rentals with the potential for both high gross annual rental yields and low owner-occupancy rates—a sign of strong demand from prospective renters.

These markets provide strong potential rental yields for properties purchased in 2016 along with low owner-occupancy rates for single-family homes, meaning that a high percentage of folks living in a home don’t own the home, but are renters. That is good news for single-family rental investors as it shows a broad base of demand from renters in that market.

All 18 markets on the list have a potential gross annual rental yield (annualized rental income divided by median sales price) of at least 10 percent for homes purchased in 2016, and at least 33 percent of all single-family homes in these 18 markets are non-owner-occupied.

The five most populous counties making the list are Baltimore City, Maryland; Clayton County, Georgia, in the Atlanta metro area; Richmond City, Virginia; Yuma County, Arizona, in the Yuma metro area; and Richmond County, Georgia, in the Augusta-Richmond metro area.

Counties on the list with the highest share of non-owner occupants were Bibb County, Georgia, in the Macon metro area (45.7 percent); Monroe County, Pennsylvania, in the East Stroudsburg metro area (43.5 percent); Sumter County, South Carolina, in the Sumter metro area (42.3 percent); Davidson County, North Carolina, in the Winston-Salem metro area (42.1 percent); and Wicomico County, Maryland, in the Salisbury metro area (41.9 percent).

Millennial Meccas with High Potential Yields

Millennial Meccas with High Potential Yields

A growing population of Millennials should translate into growing demand for single-family rentals as those Millennials reach life milestones such as marriage and kids that may warrant a move from an apartment to a single-family home. And eventually, those Millennials may provide single-family rental investors a convenient exit strategy for selling their homes. We identified the 17 best markets we consider Millennial meccas that also boast high potential gross rental yields.

We only included counties where Millennials—those born between 1981 and 1997 — accounted for at least 25 percent of the population in 2014 and where the Millennial population grew from 2013 to 2014. Lastly, all counties on the list have a potential gross annual rental yield of at least 10 percent for properties purchased in 2016.

The five most populous counties making the Millennial mecca list were Philadelphia County, Pennsylvania (10.1 percent gross annual rental yield); Milwaukee County, Wisconsin (13.1 percent); Prince George’s County, Maryland, in the Washington, D.C., metro area (10.1 percent); Duval County, Florida, in the Jacksonville metro area (11.2 percent); and El Paso County, Texas (11 percent).

Counties on the list with the highest share of Millennials were Onslow County, North Carolina, in the Jacksonville metro area (37.6 percent of population millennials in 2014); Richmond City, Virginia (33.1 percent); Bell County, Texas, in the Killeen-Temple metro area (30.1 percent); Richland County, South Carolina, in the Columbia metro area (30.1 percent); and St. Louis City, Missouri (29.3 percent).

Hidden Gems

Hidden Gems

And finally, we identified high-yield single-family rental markets that are hidden gems, undiscovered by the big institutional investors who have dominated some markets, pushing up prices and compressing yields in those markets.

We narrowed the list down to 28 hidden gems by including only counties where institutional investors (those entities purchasing at least 10 properties in a calendar year) account for less than 3 percent of all single-family purchases so far in 2016 and where the potential gross annual rental yields for properties purchased in 2016 is at least 10 percent.

The five most-populous counties making the list were Philadelphia County, Pennsylvania (10.1 percent potential gross annual yield); Macomb County, Michigan, in the Detroit metro area (11.4 percent); Kent County, Michigan, in the Grand Rapids metro area (10.1 percent); Ocean County, New Jersey (10.4 percent); and Camden County, New Jersey, in the Philadelphia metro area (11.8 percent).

Counties making the list with the lowest share of institutional investor purchases were Ocean County, New Jersey (0.9 percent); Kent County, Michigan, in the Grand Rapids metro area (1.3 percent); Atlantic County, New Jersey, in the Atlantic City metro area (1.3 percent); Richmond City, Virginia (1.3 percent); and Ulster County, New York, in the Kingston metro area (1.5 percent).

0 Comments