New data has pushed housing to the forefront of the recovery discussion. Can the economy recover without housing? What has gone wrong with it?

New data has pushed housing to the forefront of the recovery discussion. Can the economy recover without housing? What has gone wrong with it?

If housing is de-emphasized as never since the Depression, what does it mean for inequality, the new darling of the Left, and the free-market pleasure of the Right?

Other news, quickly: orders for durable goods sparkled in March, the 2.0% gain doubling the forecast. U.S. manufacturing is hot. Goody. Maybe 18% of GDP. Would you like your college grad to work for General

Motors, making stuff, or for Google which makes nothing?

Vladimir Putin the Stupid is in a one-man Mexican standoff. German Chancellor Angela Merkel spoke for the first time in weeks, accusing Putin of “imposing his will with the barrel of a gun and force of a mob.” Much as Germany would like to be an overlarge and changeless Switzerland, I think Putin has underestimated European resistance. The threat of imminent conflict creates a steady bid for U.S. Treasurys.

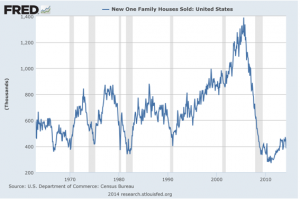

As does deflation in Europe, and an ever-closer endgame in Japan, and above all U.S. housing numbers too painful for many to discuss — and those who have tried have gotten wrong. March sales of new homes, defined as a purchase contract written on a dwelling any time after the building permit, cratered 14.5%.

The financial media led by the Wall Street Journal and Bloomberg say the problem is home prices rising too fast and higher mortgage rates. Housing is too important to the nation for old grudges to distort reporting this way. Stock market types hate housing and its competition for client investment, and delight in finding fault.

The real story, one piece at a time:

1. Every U.S. recession recovery since World War II has been propelled by housing, specifically the benefit of rising prices, which continue to rise until the next recession. The price-rise loop is so strongly positive that the next recession follows the Fed forced to lean into housing’s inflationary impact. Rising prices create several beneficial wealth effects: increased equity encourages everything from trade-up to debt payoff to tuition for Egbert. National home prices are today no more than 10% up from an overshot bottom, the rise exaggerated by bulk-buying cash-paying cripple-shooters.

2. Mortgage rates are higher than the brief quantitative easing 3 period near 3.50% from mid-2012 to mid-2013. However, that was a refinance boon — it did not last long enough for the housing stock to re-price accordingly. We sit barely 4.50, under the baseline 2009-2011. More important: in each post-war recovery mortgage rates had to rise a full two percentage points from recession baseline to slow the market.

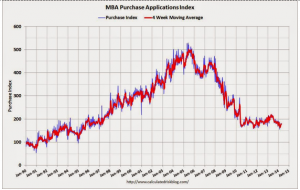

One financial publication says, “The decline in mortgage lending… stemmed almost entirely from the slide in refinancing. Loans for purchases were basically flat.” Two paragraphs later: “Applications for purchase mortgages last week ran nearly 18% below… a year ago.” If you’re going to run propaganda, get it straight.

3. New-home sales provide a minor gross domestic product boost, perhaps 3% of total when running hot. The economic propellant to recession escape is home prices. All hot markets across the U.S. are short of inventory, buyers often in auction conditions. How can a minor rise prices stall construction drowning in demand?

4. The deepest problem with housing today is reverse-circular. In a normal recovery the drop in mortgage rates unleashes demand. In the aftermath of the Great Recession too many households are damaged, especially those aged under 40. Inferior replacement of jobs, savings run down, credit damaged, flat wages inhibiting savings.

5. All made worse by credit too tight, especially for two classes of new construction at entry-level: condo and mixed-use.

We’ll see if we can have an accelerating recovery without housing. Households themselves… since the 1930s the one reliable way for a family to build net worth has been the prudent purchase of a home even with little (FHA) or nothing (VA) down, modest discipline and patience. Remove housing as that vehicle, and young Americans have this option: paycheck savings handed to the stock market.

—————————————————

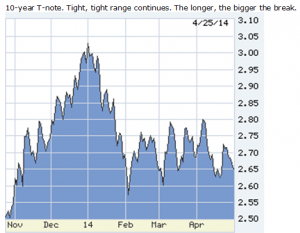

10-year T-note. Tight, tight range continues. The longer, the bigger the break. Click on the charts below to enlarge.

Applications chart has its distortions: ’90-’92 were recession years. The Fed tightened hard in ’94, mortgages from 7.00% to 9.50% which slowed market but did not stop it. 2003-2007 was idiots’ Bubble delight. Where should applications be? Given pent-up demand from Great Recession and larger population, rising toward 300,000/month. Instead, falling.

Note very strong upward runs beginning IN each prior recession, pulling recovery forward.

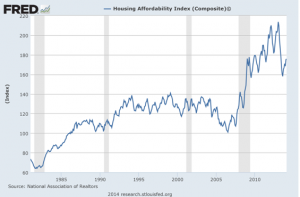

Mortgage rates are a tad up from bottom, but rates are so low that household payments are all-time low. The notion that higher rates have cut off mortgage demand is an irresponsible fable.

Same story, different verse. “Affordability” is inexact, highly variable by region, but the chart is not a close call.

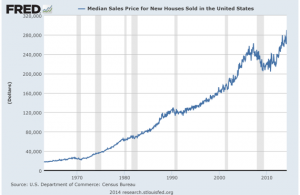

Price chart goes clear back to 1975. Note prices flattening at onset of recession, uninterrupted rise until next recession.

Same story, new homes.

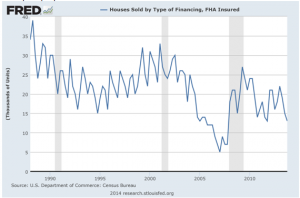

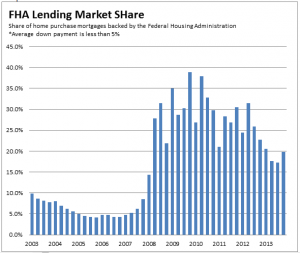

FHA share by number of loans. In 2013 FHA took annual mortgage insurance from .55%, roughly where is had been for 50 years, to 1.35%. PER YEAR, no cancellation when principal paid down.

FHA share by dollar volume. FHA has kept its underwriting unchanged; thus its volume collapsed when subprime gave money away, rose dramatically when all other lending collapsed.

0 Comments