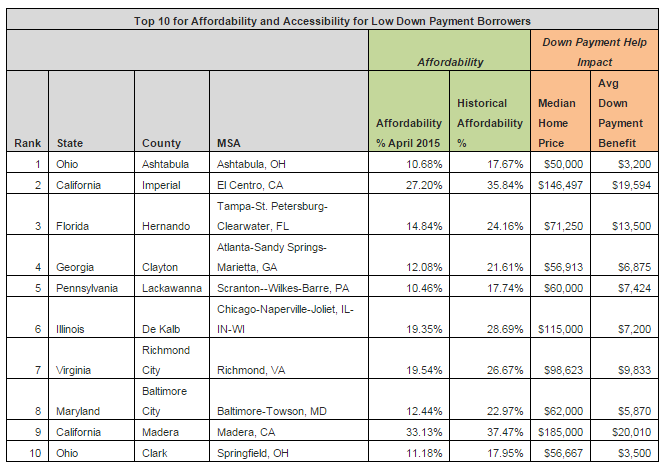

A new analysis of low-down payment buyers, such as first-time homebuyers, and boomerang buyers from RealtyTrac.com and Down Payment Resource ranks 370 counties across the U.S. in terms of affordability and accessibility for these types of buyers and what it means for real estate investors.

“This report helps investors identify whether a fix-and-flip strategy or buy-to-rent strategy is the better option in a given market,” Daren Blomquist, vice president of RealtyTrac, told Personal Real Estate Investor Magazine.

“In markets that rank high for affordability and accessibility of down payment help for first time buyers and boomerang buyers, the fix-and-flip strategy may be a better option as there should be strong demand from a larger pool of potential buyers for the fix-and-flip end product – assuming of course that other market fundamentals such as population change and unemployment rates are good.

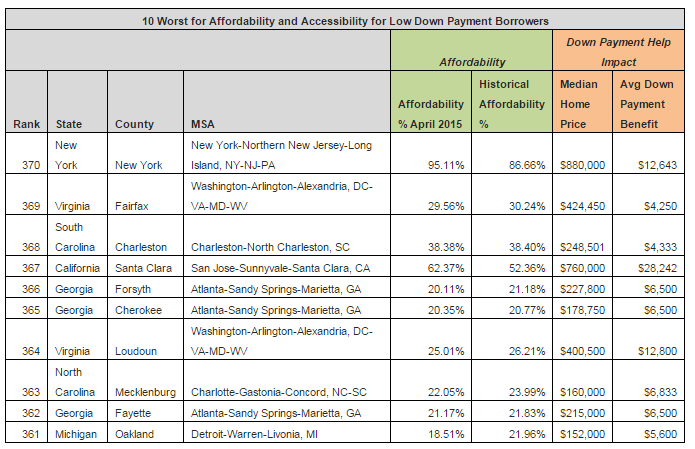

“In markets that rank low for affordability and down payment help accessibility, the fix-and-flip investor may have a tougher time finding buyers for his or her product. On the other hand, these markets that are less accessible for the first-time buyer and boomerang buyer may be great markets for employing the buy-to-rent strategy, as there is likely to be stronger demand for rentals from those folks who cannot afford to buy,” Blomquist told Personal Real Estate Investor Magazine.

Low down payment buyers often need help

“This analysis demonstrates that low down payment borrowers can find affordable housing and good accessibility to down payment help in a wide variety of markets nationwide,” Blomquist said in the release. However, within many major metro areas the most affordable and accessible markets for low down payment buyers are often those furthest from jobs and other amenities that many buyers want.”

Housing entry cost is challenge for low down payment buyers

“Housing affordability is a critical issue for all buyers today. This report underscores the fact that there are significant missed opportunities for down payment help, even in the areas ranked worst in affordability. There are programs in every community that could increase housing affordability for buyers, especially first time and boomerang buyers,” Rob Chrane, CEO of Down Payment Resource, said in the release. “The entry cost for homeownership is the greatest challenge for all buyers. This report highlights how homebuyers can save on their home loan when they access available programs.”

90 percent of U.S. markets analyzed still more affordable than historic averages according to the RealtyTrac.com

study.

Of the 370 counties analyzed, 334 (90 percent) were more affordable for low down payment buyers in April 2015 than their historic averages. Read the full report from RealtyTrac.com here.

[hs_form id=”4″]

0 Comments